30+ Fixed rate mortgage calculator

Your monthly payment stays the same for the entire loan term. 30 Year Fixed 6250.

Best 10 Mortgage Calculator Apps Last Updated September 1 2022

Imagine a 500000 mortgage with a 30-year fixed interest rate of 5.

. A fixed rate mortgage offers the security of consistent payment. The amount of your regular mortgage payments. Find average mortgage rates for the 30 year fha fixed mortgage from Mortgage News Daily and the Mortgage Bankers Associations rate surveys.

Meanwhile the current average rate for the benchmark 30-year fixed mortgage is 595 rising 3 basis points over the last week. A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. A 30-year fixed-rate home loan is a mortgage that will be completely paid off in 30 years if all the payments are made as scheduled.

A fixed rate mortgage offers a specific interest rate that is fixed or locked-in for the term of the mortgage. We offer a wide range of loan options beyond the scope of this calculator which is designed to provide results for the. Right now the introductory rate on a 51 ARM is 435 vs.

Use a mortgage payment calculator. Find out how to best use a fixed rate to your advantage. 20 to 30 Year Fixed Rate.

15 Year Fixed 5000. Or call us. 4 footnote 4 details Calculator.

Average rates for a 30-year fixed-rate mortgage surged as high as 581 in late June but have since leveled off at 555 as of August 25 according to Freddie Mac. If you paid an extra 500 per month youd save around 153000 over the full loan term and it would. Using our mortgage rate calculator with PMI taxes and insurance.

When mortgage rates are at a low interest period a fixed-rate mortgage may make the most sense. Find out about the longest fixed rate mortgages available in Australia. Safis says the average rate difference between a 106 ARM and a 30-year fixed mortgage can be about 05 to 075.

Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today. Apply online for a fixed rate mortgage to see current rates and mortgage calculations today. The portion of your payment that goes toward principal and interest.

We offer a number of calculators that makes it easy to compare 2 terms side-by-side for all the common fixed-rate terms. At the bottom of each calculator is a button to create printable amortization schedules which enable you to see month-by-month information for each loan throughout. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years.

Thats still nearly double. With a fixed-rate loan the interest rate remains the same for the entire span of the mortgage. The free mortgage calculator is a versatile tool as useful to an individual casually researching properties as it is to someone on the cusp of making a purchase.

10 or 15 10 or 20 10 or 30 15 or 20 15 or 30 20 or 30. If you take out a 30-year fixed rate mortgage this means. Bank mortgage loan officer can help you learn more.

On Thursday September 01 2022 the national average 30-year. However when interest rates are rising its a different market. Lock-in Redmonds Low 30-Year Mortgage Rates Today.

That means youll know exactly what to expect including. 20 Year Fixed 5750. A basis point is equivalent to 001 Thirty-year fixed mortgages are the most.

Todays national 30-year mortgage rate trends On Thursday September 01 2022 the current average rate for the benchmark 30-year fixed mortgage is 595 rising 3 basis points over the last seven. Freddie Mac reported an average mortgage rate for 30-year FRM of 309. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily Freddie Mac etc.

By default 250000 30-yr fixed-rate loans are displayed in the table below. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability. Refinance to a fixed-rate mortgage.

Stability Youll be able to lock in the interest rate on your mortgage for the entire 30-year term. The majority of fixed rate home loans are locked in for a term of 3 to 5 years. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance.

Mortgage rates valid as of 31 Aug 2022 0919 am. Filters enable you to change the loan amount duration or loan type. The interest rate of your mortgage.

Mortgage rate forecasts predict a continued increase by years end which some attribute to inflation driven by temporary supply-chain issues. How much money could you save. The main advantages of a 30-year fixed mortgage are outlined below.

A basis point is equivalent to 001 Thirty-year fixed mortgages are the most. When talking about a 30-year fixed-rate mortgage it typically refers to conventional loans. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher.

30 Year Fixed. Is it possible to have fixed home loan interest rates last 20 years or 30 years. To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan.

The average 30-year fixed mortgage interest rate is 554 which is a decrease of 3 basis points from one week ago. The 30-year fixed-mortgage rate average is 587 which is an increase of 40 basis points from one week ago. N 30 years x 12 months per year or 360 payments.

This gives you a degree of predictability you wont have with an adjustable-rate mortgage ARM. So which one makes better sense an adjustable-rate mortgage or a fixed-rate mortgage. 3 Year Fixed Rate.

Rates on a 30-year fixed rate mortgage FRM ran between 395 on the low end and 534 on the high. 551 for the 30-year fixed. For example if your loan closes on the 20th day of a 30-day month at closing you will pay interest owed for the remaining 10 days of that month.

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

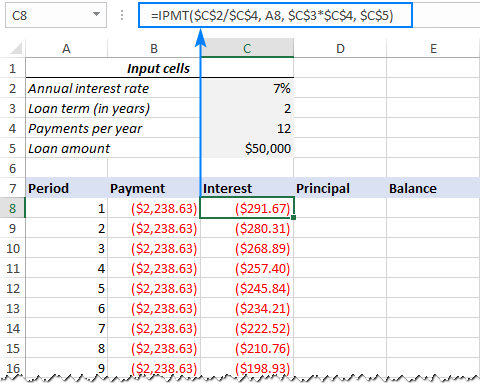

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

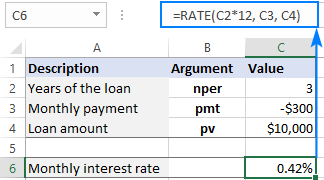

Using Rate Function In Excel To Calculate Interest Rate

Best Mortgages In Canada Comparewise

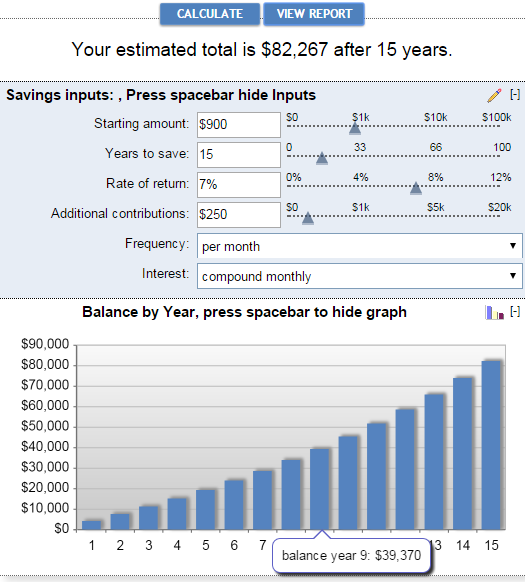

The Best Retirement Calculators 2022 Can You Retire Early Part Time Money

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

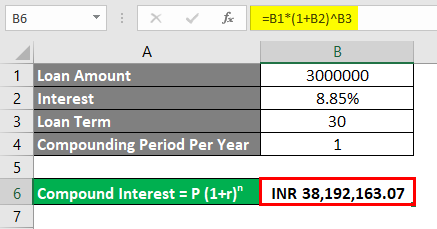

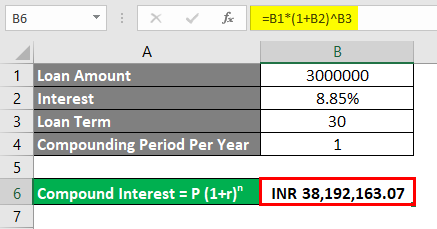

Compound Interest Formula And Calculator For Excel

The Best Retirement Calculators 2022 Can You Retire Early Part Time Money

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

Airbnb Stay Tracker And Management Expense Cleaning Fee Etsy Rental Income Rental Property Management Airbnb

Calculate Compound Interest In Excel How To Calculate

Calculate Compound Interest In Excel How To Calculate

The Best Retirement Calculators 2022 Can You Retire Early Part Time Money

Best 10 Mortgage Calculator Apps Last Updated September 1 2022

Mortgage Calculators Lowermybills Mortgage Refinance Mortgage Mortgage Help

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora